Condo Insurance in and around Baltimore

Welcome, condo unitowners of Baltimore

Cover your home, wisely

Your Search For Condo Insurance Ends With State Farm

Are you investing in condo ownership for the first time? Or have you been around the block a few times? Either way, it can be a good idea to get coverage for your unit with State Farm's Condo Unitowners Insurance.

Welcome, condo unitowners of Baltimore

Cover your home, wisely

State Farm Can Insure Your Condominium, Too

With this protection from State Farm, you don't have to be afraid of the unexpected happening to your unit and personal property inside. Agent Cyndi Kuhn can help lay out all the various options for you to consider, and will assist you in constructing a wonderful policy that's right for you.

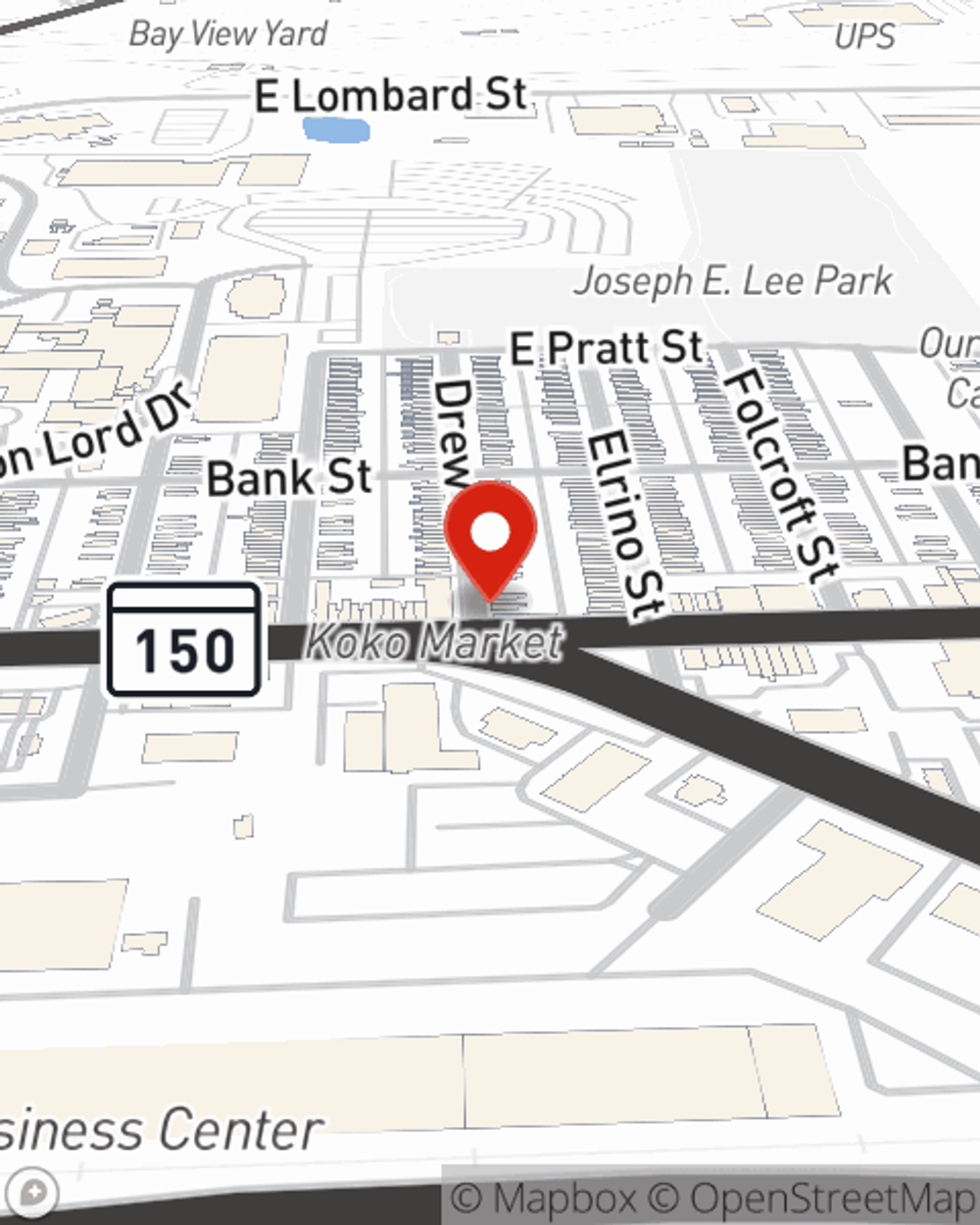

Getting started on an insurance policy for your condo is just a quote away. Stop by State Farm agent Cyndi Kuhn's office to learn more about your options.

Have More Questions About Condo Unitowners Insurance?

Call Cyndi at (410) 633-5000 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.